Tuesday, January 3, 2012

VC Exits Down In 2011, Says Report

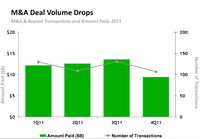

The number of exits by U.S., venture backed companies was down in 2011, according to Dow Jones VentureSource, which said today that it tallied a total of 522 mergers, acquisitions, buyouts, and IPOs during the year. Dow Jones said that those exits totaled $53.2 billion, a 14 percent drop in deal activity versus 2010, although it was a 26 percent increase in capital raised compared to last year. The report found that companies raised a median of $17M in venture financing before M&A or buyout, and took a median of 5.3 years to build their company before acquisition. The median price for a company increased to $71M during 2011.

Those numbers were bolstered by a good year for IPOs, with forty-five companies raising $5.4 billion in public offerings in 2011. That's more than the $3.3 billion raised by 46 companies in 2010. The difference in capital raise was due primarily to two hot Internet companies, Groupon and Zynga, which between the two were responsible for $1.7 billion in their IPOs. Dow Jones says that there are now 60 U.S. venture-backed companies in registration for an IPO.